Better Tenant Screening

Reduce Vacancies, Reduce Risk, and Save Money.

We built RentScreener, the most powerful online tenant screening product in the industry, and now that same technology is part of Rentvine. And it’s more powerful than ever.

Schedule a Demo

Approving Rental Applicants Has Never Been Easier!

Size Doesn’t Matter!

Whether you have 1 property or 10,000, we have the perfect solution for your company.

Customizable Application

Our team will help you turn your current rental application into a secure online application.

Instant Screening

We partner with TransUnion, the leader in resident screening, for instant tenant reporting.

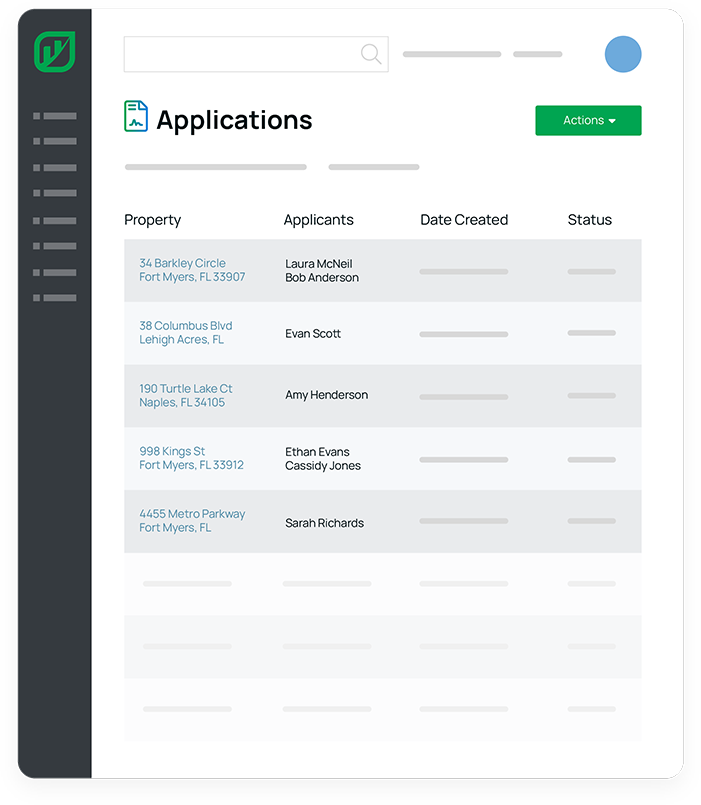

Secure, Online Rental Application With Flexible Screening Options.

Customizable Online Application

Replicate and customize your rental applications online, including addendums, instantly. Run your business your way!

Instantaneous Reporting.

We’ve partnered with industry leader TransUnion to provide the fastest, most accurate, and easiest way to access tenant data. Instantly get credit, criminal, and eviction data on every applicant. Make more informed decisions and reduce risk.

Customized Screening Options to Fit Your Needs.

- Credit Only (Credit Report Only)

- Credit, Eviction (Credit Report Only and Eviction)

- Credit, Sex Offender Only, Eviction (Credit Report, Sex Offender Only, and Eviction)

- CR Lite (Credit Report Only and National Criminal Search)

- CR Lite Plus (Credit Report Only, National Criminal Search, and Eviction)

Don’t see a package that fits your needs or have questions about the screening process and how it integrates with Rentvine?

Get Screening HelpApplication & Screening Packages

RentGrade

Set up a RentGrade Account with a Customizable Application, Application Fee, and choose how you want to pay the Processing Fee. You will run your screening and our system will provide you with a RentReport which includes a RentGrade along with any criminal and eviction history.

Application Fee:

RentGrade Report Fee:

Plus $10.00 processing fee

Paid to Rentvine.

See pricing example

FEATURES:

- Customizable Online Application

- Customizable Terms

- Document Upload

- Historical Timeline

- Adverse Action Letter

- Built In eSignature

- ACH Direct Deposit

- Notes Section

- Messaging System

- Status Management

- Support

- Addendums

- Refunds

- Payments

- Reports

- Security

- Customizable Application Fee

- RentReport with RentGrade

FEATURES:

- Customizable Online Application

- Customizable Terms

- Document Upload

- Historical Timeline

- Adverse Action Letter

- Built In eSignature

- ACH Direct Deposit

- Notes Section

- Messaging System

- Status Management

- Support

- Addendums

- Refunds

- Payments

- Reports

- Security

- Customizable Application Fee

- RentReport with RentGrade

TransUnion

TransUnion Integration is recommended for Property Managers that need to get reports directly from the bureau and run a credit, criminal, and eviction check on applicants.

This account setup may take up to 30 days due to the TransUnion Membership Process you will have to undergo if you should decide to go this route.

Application Fee:

Plus $10.00 processing fee

Paid to Rentvine.

TransUnion Screening Fee: Prices Vary

See pricing example

FEATURES:

- Customizable Online Application

- Customizable Terms

- Document Upload

- Historical Timeline

- Adverse Action Letter

- Built In eSignature

- ACH Direct Deposit

- Notes Section

- Messaging System

- Status Management

- Support

- Addendums

- Refunds

- Payments

- Reports

- Security

- Customizable Application Fee

- TransUnion Reports Per Selected Screening Package

TransUnion Screening Fee: Prices Vary

See pricing exampleFEATURES:

- Customizable Online Application

- Customizable Terms

- Document Upload

- Historical Timeline

- Adverse Action Letter

- Built In eSignature

- ACH Direct Deposit

- Notes Section

- Messaging System

- Status Management

- Support

- Addendums

- Refunds

- Payments

- Reports

- Security

- Customizable Application Fee

- TransUnion Reports Per Selected Screening Package

Calculate Cost

Accept, Sign, & Collect Securely Online. One Partner, With All the Features to Find Better Tenants for Your Rental.

-

Unlimited Customizable Online Application Templates

Rentvine’s application template builder allows you to customize your existing rental application online and create as many different application templates as needed. Choose which sections you need, pick which fields are required or optional, and include addendums. Then simply choose which application applies to which property.

-

Document Upload

The document center makes it easy for applicants to upload any document required to process their rental application. Tenants can upload their documents while completing their application right from their computer or mobile device using the integrated camera. Set a minimum requirement for document upload to make sure that you get a fully completed application with all necessary documents attached.

-

Communication Made Easy

Notify and communicate with applicants quickly and easily with our integrated email and text messaging system. Need a template for that email? No problem, you can set up as many email and letter templates as needed. Instantly notify applicants and agents of any status change with our CUSTOM STATUSES. Request additional information and track all communication with every user on the timeline.

-

Payment and Refund Processing

With built in payment processing, there is no need for a merchant account, payment gateway, high monthly fees, transaction fees, lengthy qualification process, refunds or other hassles. All of these services are included in our $10 processing fee charged to the applicant.

-

Historical Timeline

Track what happened, when it happened, and who did it, with our online application’s historical timeline. Every event that happens in our system is tracked including status changes, notes, letters, application changes, and all communications with all parties involved.

-

Signatures & Addendums

Apply signatures to the application and any addenda. Need applicants to initial certain terms? We can handle that too. Our electronic signatures work on any device.

-

Security

From the data collection to the notifications, each part of Rentvine’s application system has been carefully designed and architected to keep the applicant's data secure. Define user roles and set specific permissions for agents that access your account.

Simple Pricing. Unlimited Value.

Open API, free maintenance, free eSignatures, free future updates at no extra cost. No hidden fees. No Surprises. Full software access. Your life just got easier.

Rentvine's all-inclusive per-unit pricing, includes powerful Reporting Capabilities, Inbound ACH Fees, Premium Integrations, Purchase Order & Tracking, NACHA Files, Dedicated Customer Support, Custom Fields…and so much more.

$2.50

Per unit per month. $199/mo minimum.

Additional fees for tenant screening and transactions may apply.

Automate your business with best-in-class property management software.

Never miss out on another client because your software can’t handle sophisticated investors.

Get Started